Investment Banking

Our purpose is to serve a diverse client base of issuers and investors including corporations, financial institutions and governments across the region. We aim to provide our clients with opportunities supported by strong regional relationships and a profound understanding of local economies, industries and different cultures. Our dedicated team continuously strives to identify and execute innovative public and private market transactions.

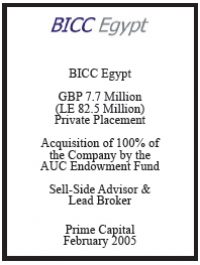

- Equity and debt issuance

- Mezzanine financing

- Private placements

- GDR listings

- Privatization

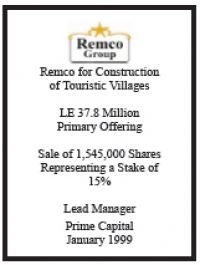

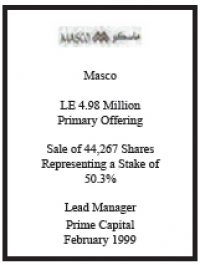

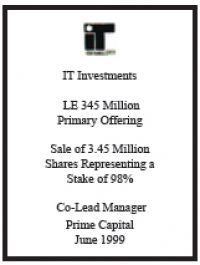

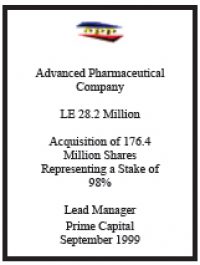

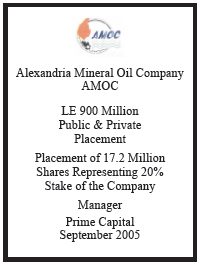

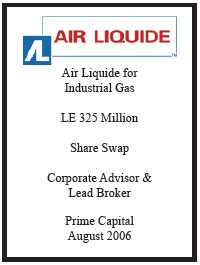

Prime provides structuring and execution of various debt and equity financing, in addition to prerequisites such as strategy formulation, valuation and business plan preparation. Our team provides support in the origination of primary market transactions and manages their structuring, syndication, marketing and distribution. Hence, our scope of activities stretches from the largest privatizations, initial public offerings and secondary placements to smaller public transactions and private placements.

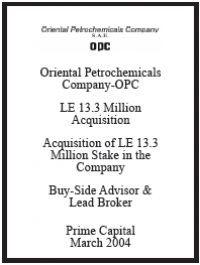

- M&A advisory

- Divestitures

- Joint ventures

- Leveraged and management buyouts

- Defense against unsolicited takeover

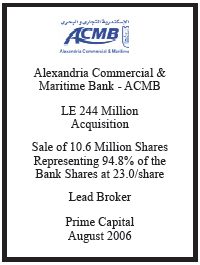

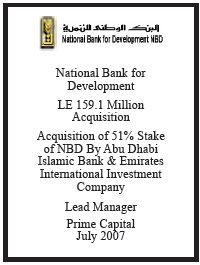

Our company handles M&A activities by establishing and maintaining strategic relations with existing and potential clients. It is our duty to provide complete advisory and strategic solutions to assist clients in achieving short and long term goals. Our services encompass pre-transaction evaluation and valuation of the client, candidate short-listing, candidate valuation, transaction structuring, financing and refinancing arrangements, negotiation assistance, and due diligence management.

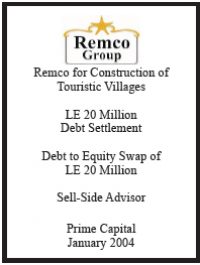

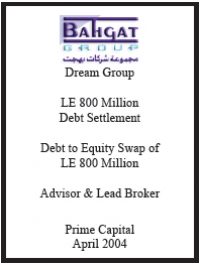

- Strategic and corporate restructuring

- Financial restructuring

- Valuation

- Debt Arrangements

- Debt Restructuring

Prime provides strategic, financial and corporate restructuring advisory to businesses attempting public offering, private placement and/or seeking higher profitability. Our professional team analyses thoroughly all aspects of the enterprise, designs restructuring programs and oversees their implementation. At Prime; we seek to enhance the overall value of the client through strategic planning and management.

Prime offers the clients a variety of financial restructuring scenarios to align them with their strategic plans in terms of arranging adequate debt and equity structure that is beneficial for the client.

| Omar Badreddin – Managing Director |

| Omar has extensive experience of more than ten years in diversified aspects including; Equity Valuation, Feasibility Studies, Financial Consulting, Business Modeling & Analysis, Corporate Finance, Business Reviews, IPO’s Valuations, Impairment Test Assessment and Financial Reporting. Prior to joining Prime Capital, Omar was investment associate at Karvy for Financial Advisory Services and also worked for Fincorp investment holding as Investment Associate. Omar also Managed the investment fund of Arab Fertilizers Association for 4 years prior to joining Fincorp. During his professional career, Omar covered various economic sectors including; Petrochemicals, Tourism, Real Estate, Fintech, Logistics, Construction and Materials, Financial Services, Health Care, and Education. Omar is a chartered financial analyst (CFA) Certified Management Accountant (CMA) and Financial Modeling and Valuation Analyst (FMVA ). Omar obtained his bachelor’s degree in accounting from Cairo University in 2011. |

| Ahmed Saleh Aboueita – Vice President |

| Ahmed has over 3 years of in-depth financial sector experience. He has started his career at HLB – Egypt where his main responsibility was to prepare economic, financial and market feasibility studies for various clients in different sectors including real estate, infrastructure, and financial services. The World Bank Group, EBRD, GIZ, Orascom Construction, Madinet Nasr for Housing & Development and Al Marasem International for Development are some of the clients that Ahmed has worked for. Ahmed was responsible for preparing analytical, performance and valuation reports in order to advice clients about historical performance and investment opportunities. Ahmed joined Prime Capital in 2019 as a senior analyst in the Investment Banking department. Since joining Prime Capital, Ahmed has worked on preparing and building valuation models and reports utilizing a range of valuation techniques including DCF, Market Multiples & Net Asset Valuation (NAV). Ahmed aslo is responsible for preparing/ reviewing information memorandums, Presentations, valuation reports, and IFA reports. Another part of his role is to solicit new business opportunities with clients and prospects for corporate transactions such as equity fund raising, buy/sell side advisory and debt issuance. Ahmed graduated cum laude from the American University in Cairo in 2015 with a major in Business Administration with a concentration in Finance and a minor in Economics. Ahmed is preparing for CFA level I exam in December 2020. |