Asset Management

Prime Asset Management (PAM) is a leading regional investment management firm established in 1995, extending its services to government pension plans, financial institutions, corporations, endowments, family foundations, and private individual clients.

Our current mandated assets under management amount to LE 13.55 Billion. Prime Asset Management currently manages 5 local funds.

Our active team of professionals manages investments using a sound qualitatively driven approach known as the “top down dynamic asset allocation approach” to ensure stability and consistency of the investment process in order to reduce portfolio volatility placing emphasis on the preservation of capital. Our team also focuses on high value added investment solutions with a disciplined investment process that emphasizes risk management while adhering to strict fiduciary standards.

The foundation of our investment policy lies in developing and maintaining a trustworthy relationship with our clients in addition to achieving customer satisfaction both in performance and service by adopting a disciplined trading system to diversify, control risk and mitigate volatility. This is done with the highest level of integrity and professionalism.

Our business objectives focus on the following factors:

- Capital Preservation: Protecting the original value of the fund is an overriding priority

- Risk Control: Investments focus on a high quality class of securities

- Liquidity: Investments are directed to only highly liquid and marketable securities

- Concentrating on top credit quality

- Achieving growthgovernments across the region.

We aim to provide our clients with opportunities supported by strong regional relationships and a profound understanding of local economies, industries and different cultures. Our dedicated team continuously strives to identify and execute innovative public and private market transactions.783

The foundation of our investment philosophy includes:

- Developing and maintaining a genuine partnership with each client.

- Placing client interests before our own.

- Building value for each client through long-term perspective on investments, offering only the highest quality investment solutions.

- Adopting a disciplined trading system, diversification, controlling risk, and mitigating volatility.

- Providing the highest quality client service available in the financial industry, including easy access to management and client service teams.

- Protecting each client through rigorous adherence to a demanding code of ethics.

- Focusing on individual client objectives and goals with the aim of increasing the value of investments of our clients over time, and reducing portfolio volatility with special emphasis on the preservation of capital.

- Our primary target is to achieve customer satisfaction both in performance and service, with the highest level of integrity and professionalism.

Portfolios

When it comes to managing people’s money, we are very much aware of the fact that there is no one Mutual Fund or Portfolio mix that can be suitable to everybody. We always try to stretch ourselves and to be innovative to structure more ideas and types of funds and portfolios, either locally or offshore. Prime Asset Management provides a wide range of products to meet different preferences through managing either mutual funds or portfolios under the following types:

Mutual Funds and Portfolios Types

- Equity

- Bond

- Hybrid / Balanced

- Index

- Money Market

- Capital Preserved (guaranteed)

- Sharia’h Compliant

Pure Equity Funds/Portfolios Objectives

- Aggressive Growth: Invest in small/medium growth companies

- Growth: Invest in well established companies

- Growth and Income: Combine long-term capital growth with steady income dividends

- Income Equity: Invest in equities with adequate stream of dividends

- Sector Equity: Invest in specific industries

- Emerging Market Equity / Regional Equity / International Equity

Pure Bond Funds and Portfolios Bond Types

- Government: Housing & Treasuries

- Corporate (unsecured)

- Guaranteed

- Collateralized or Asset-Backed

Hybrid / Balanced Funds & Portfolios

The main objective is to invest in specific dynamic mix of equity and bonds while conserving capital, providing income, and achieving long term growth.

- Flexible: seeks high total return from all types of securities with no limitations on weights

- Asset Weighted: invests in a mix of securities but strictly maintaining precise weighting in asset classes

PAM Team

The PAM team consisting of several committees adopts a team oriented approach to collaborate in cooperating together to ensure delivering the best service possible to our clients. The Prime Asset Allocation Team consists of the following:

Asset Allocation Committee:

Identifies the global asset allocation and makes asset allocation decisions across asset classes and sectors. The committee sets the allocation policies and general guidelines for different portfolio models and strategies

Investment Strategy Team:

Develops different allocation strategies to support the investment / portfolio management team by providing alternative investment solutions through investing funds in the broad categories of assets (such as stocks, bonds, cash, etc.), addresses clients investment time horizon and match risk tolerance, evaluates and structures new products, applies intensive screening for potential investments, develops trade ideas, establishes market views and implements quantitative analytics in portfolio optimization

Research Team:

Produces investment analytics across the region and within sectors. Quality of the analysis is enhanced through various researches pooling from a variety of brokerage firms located in the region, which strengthens our analysts’ rationalization and markets sentiments over companies. Research is vital to the PAM investment decision making process

Portfolio Management Team:

Applies the ideas and research generated by the research team and asset allocation committee to the individual client portfolios based on specific client guidelines

Trading Team :

Executes trading activities according to the pre-set investment decisions

| Fund | Sponsor | Fund Name | Type | Structure | NAV | YTD% | Termsheet /prospectus |

|---|---|---|---|---|---|---|---|

|

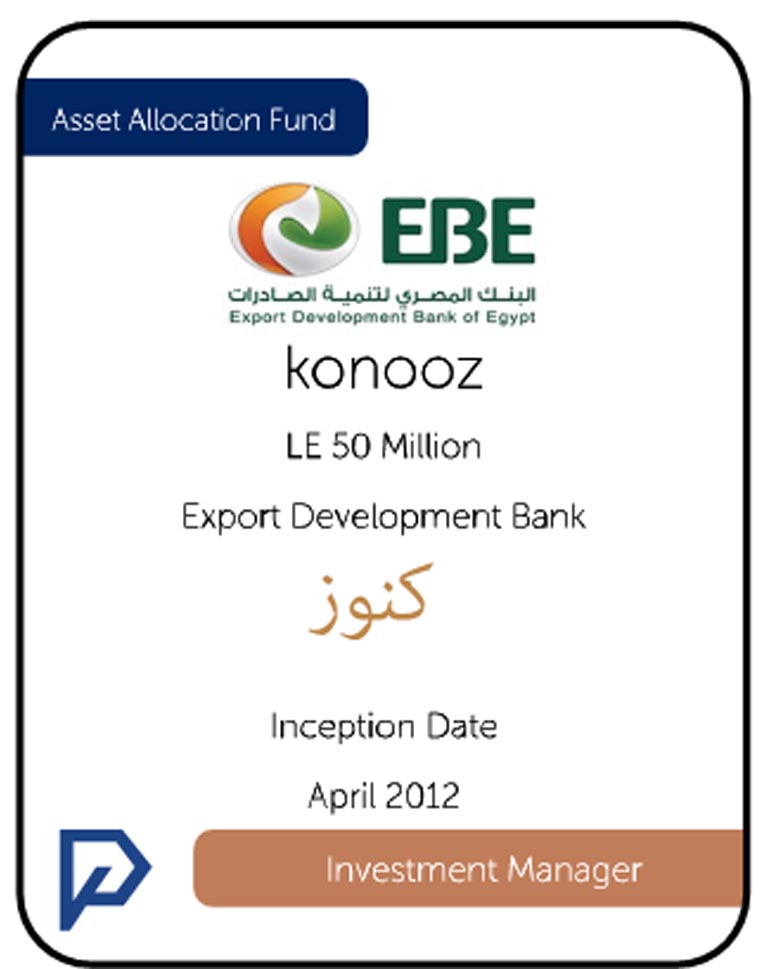

Export Development Bank | Konooz | Asset Allocator | Open-End | 748.0591 | 10.41% | Konooz |

|

|

Egyptian Gulf Bank | Tharaa | Money Market | Open-End | 42.5008 | 18.93% | Tharaa |

| Aman Micro Finance | ** Aman Money Market Fund | Money Market | Open-End | 1.69383 | 18.73% | Aman Money Market Fund | |

| Prime Holding | Prime NMW | Equity | Open-End | 11.2310 | 12.31% | Prime Holding 1st Equity Fund |

* YTD return for Money Market funds have been annualized0