Investment Banking

Our purpose is to serve a diverse client base of issuers and investors including corporations, financial institutions and governments across the region. We aim to provide our clients with opportunities supported by strong regional relationships and a profound understanding of local economies, industries and different cultures. Our dedicated team continuously strives to identify and execute innovative public and private market transactions.

- Equity and debt issuance

- Mezzanine financing

- Private placements

- GDR listings

- Privatization

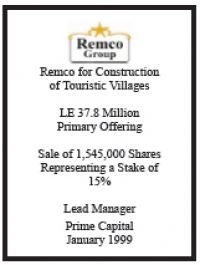

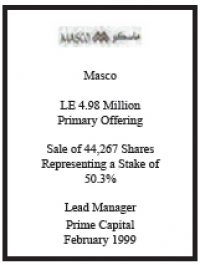

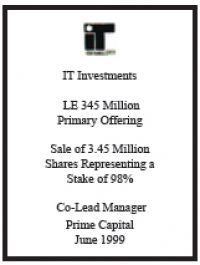

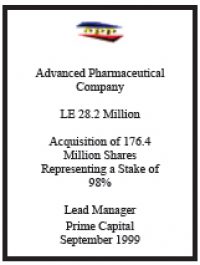

Prime provides structuring and execution of various debt and equity financing, in addition to prerequisites such as strategy formulation, valuation and business plan preparation. Our team provides support in the origination of primary market transactions and manages their structuring, syndication, marketing and distribution. Hence, our scope of activities stretches from the largest privatizations, initial public offerings and secondary placements to smaller public transactions and private placements.

- M&A advisory

- Divestitures

- Joint ventures

- Leveraged and management buyouts

- Defense against unsolicited takeover

Our company handles M&A activities by establishing and maintaining strategic relations with existing and potential clients. It is our duty to provide complete advisory and strategic solutions to assist clients in achieving short and long term goals. Our services encompass pre-transaction evaluation and valuation of the client, candidate short-listing, candidate valuation, transaction structuring, financing and refinancing arrangements, negotiation assistance, and due diligence management.

- Strategic and corporate restructuring

- Financial restructuring

- Valuation

- Debt Arrangements

- Debt Restructuring

Prime provides strategic, financial and corporate restructuring advisory to businesses attempting public offering, private placement and/or seeking higher profitability. Our professional team analyses thoroughly all aspects of the enterprise, designs restructuring programs and oversees their implementation. At Prime; we seek to enhance the overall value of the client through strategic planning and management.

Prime offers the clients a variety of financial restructuring scenarios to align them with their strategic plans in terms of arranging adequate debt and equity structure that is beneficial for the client.

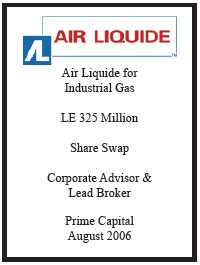

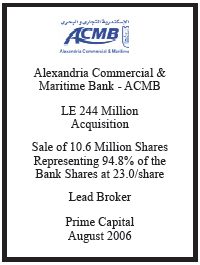

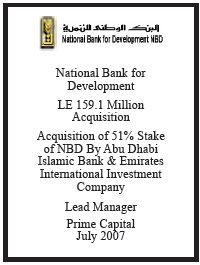

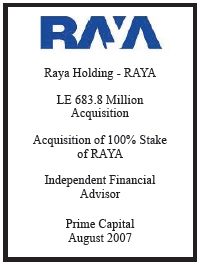

Prime Capital currently operating in different deals covering most of the industries in the Egyptian Stock market including: pharmaceuticals, healthcare, food & beverages, hospitality, chemicals, petrochemicals, industrial, real estate.

|

Mohamed Soliman – Managing DirectorMohamed Soliman is a finance professional with over eight years of experience in the banking and financial services sector, with a strong specialization in financial analysis, business valuation, and corporate finance advisory. He holds the Chartered Financial Analyst (CFA), Certified Management Accountant (CMA), and Financial Modeling & Valuation Analyst (FMVA) certifications, demonstrating his deep analytical capabilities and commitment to financial excellence. Before joining Prime Capital, Mohamed held several roles in the banking industry, developing robust experience in financial assessment, client advisory, and financial operations. His exposure to diverse financial environments has equipped him with the ability to lead and execute complex financial engagements. At Prime Capital, he leads the Investment Banking division, overseeing equity valuations, feasibility studies, IPO preparation, and strategic financial advisory. Mohamed is focused on building a high-performing team and positioning Prime Capital as a leading player in Egypt’s investment banking market. |